Why the EB5 Immigrant Financier Program Is the Smart Choice for Global Investors

The EB5 Immigrant Financier Program provides a calculated avenue for worldwide investors, offering not only the possibility of united state residency but additionally a possibility to contribute to economic growth. By guiding a minimum financial investment into targeted work locations, individuals can produce work while accessing diverse sectors such as real estate and renewable resource. This special mix of financial chance and social effect raises crucial concerns concerning its long-term advantages and dangers. What makes the EB5 program specifically appealing in today's economic climate? Exploring these measurements may disclose understandings that could affect your investment decisions.

Introduction of the EB5 Program

The EB5 Immigrant Capitalist Program, developed by the united state government in 1990, supplies a pathway for international investors to obtain irreversible residency in the United States with considerable economic investment in a certifying company. The program was made to promote the united state economy by bring in international resources and developing jobs for American workers. Financiers have to fulfill details demands to certify, consisting of a minimal financial investment amount, which is usually $1 million, or $500,000 in a targeted employment location (TEA) where unemployment is high or the population is low.To take part in the EB5 program, capitalists can either spend directly in a new or present organization or through a Regional Center, which is an entity that funds capital expense projects for EB5 investors. Investments made via Regional Centers have obtained popularity as a result of their capacity to swimming pool funds from multiple financiers, thereby lowering the individual financial concern while advertising larger-scale projects.One of the crucial elements of the EB5 program is the work creation demand. Each financial investment should result in the production of a minimum of ten permanent tasks for U.S. employees within a specified duration, ensuring that the program not just advantages financiers however also adds to the overall financial development of the country.As a consequence, the EB5 Immigrant Capitalist Program has actually come to be an appealing option for foreign nationals looking for to spend in the U.S. while all at once securing a favorable migration result for themselves and their immediate household.

Path to U.S. Residency

The EB5 Immigrant Capitalist Program provides a viable pathway to united state residency through tactical investment in qualifying projects. This program not just assists in the financier's permanent residency however also prolongs family addition benefits, allowing prompt household participants to cooperate the benefits of U.S. residency. Understanding these elements is necessary for potential investors seeking to browse the immigration procedure efficiently

Residency Via Financial investment

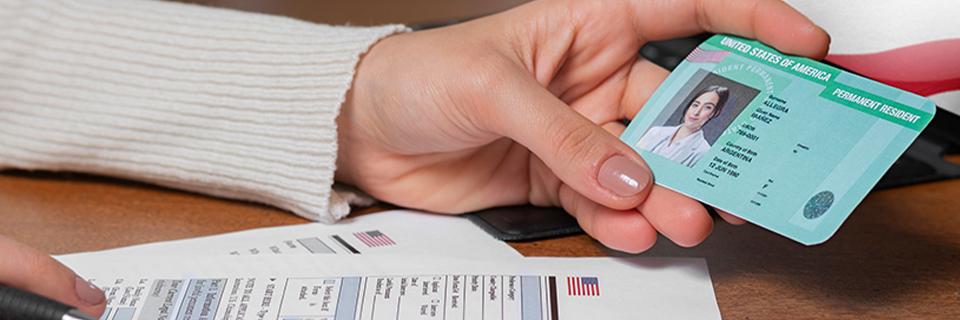

Maneuvering the intricacies of U.S. immigration can be daunting, yet the EB5 Immigrant Investor Program provides a clear path to residency through investment. This program allows foreign nationals to obtain a united state eco-friendly card by spending a minimum of $1 million, or $500,000 in targeted work areas, in a new company that produces a minimum of 10 full time work for certified U.S. workers.The EB5 program is made to promote the economic climate with job creation and capital expense, making it appealing for those seeking both residency and a return on their investment. As soon as the investment is made and the application is accepted, capitalists and their instant member of the family can obtain conditional irreversible residency for two years - EB5 Immigrant Investor Program.To change to permanent residency, EB5 financiers should show that their investment has actually met the task development requirements. This simple procedure, incorporated with the capacity for economic development, makes the EB5 program an eye-catching alternative for worldwide financiers looking to safeguard their future in the United States. By choosing this pathway, financiers not only gain residency however likewise access to the countless opportunities that come with living in among the world's most vibrant economic situations

Family Members Incorporation Benefits

One of the significant benefits of the EB5 Immigrant Capitalist Program is its stipulation for family incorporation, allowing investors to prolong residency benefits to their instant member of the family. This feature allows a qualifying investor to include their spouse and any type of single youngsters under the age of 21 in their application, developing a path for the entire family to acquire united state residency simultaneously.The capability to include member of the family greatly enhances the program's appeal, as it shows a dedication to household unity. By safeguarding irreversible residency for dependents, the EB5 program offers a distinct possibility for family members to flourish with each other in the USA, fostering a feeling of belonging and stability.Moreover, as soon as approved residency, member of the family can likewise pursue academic and employment possibility without constraints, adding to their individual and professional development. This domestic incorporation not only strengthens the investor's dedication to the U.S. economy however also reinforces the nation's diversity and cultural richness. In general, the family members incorporation advantages of the EB5 program work as an engaging reward for global investors seeking a flourishing future on their own and their loved ones in the USA.

Financial Investment Opportunities Available

The EB5 Immigrant Financier Program offers a variety of investment possibilities tailored to potential financiers. Participants can select from diverse project options, consisting of those managed by local facilities that are especially created to stimulate work creation. This concentrate on financial growth not just profits the capitalists but additionally contributes considerably to the U.S. economic climate.

Diverse Task Options

Investors looking for to take part in the EB5 Immigrant Capitalist Program take advantage of a large selection of task alternatives that accommodate numerous interests and monetary objectives. This diversity enables financiers to straighten their financial investments with individual values, danger resistance, and wanted returns. From genuine estate growths to facilities projects, the EB5 program uses opportunities throughout multiple sectors.Real estate projects, such as household and industrial growths, are specifically preferred due to their capacity for substantial returns and concrete possessions. Furthermore, capitalists can discover opportunities in markets like hospitality, healthcare, and renewable resource, each presenting distinct advantages and challenges (EB5 Immigrant Investor Program).The adaptability of task option is a vital advantage for capitalists, as it enables them to choose efforts that reverberate with their investment viewpoint and market understanding (EB5 Immigrant Investor Program). In addition, many jobs are created to boost work production and financial growth in targeted areas, straightening capitalist passions with neighborhood development.Ultimately, the varied job alternatives available with the EB5 program not just expand the financial investment landscape but likewise encourage investors to make enlightened choices that match their monetary goals and contribute favorably to the U.S. economy

Regional Center Investments

Regional Center Investments represent a noticeable method within the EB5 Immigrant Capitalist Program, giving investors with organized possibilities that frequently generate significant advantages. Regional Centers are marked by the United States Citizenship and Immigration Services (USCIS) and concentrate on advertising economic development with task creation and funding investment. These facilities assist in various tasks throughout diverse industries such as property, hospitality, facilities, and manufacturing.Investors can take part in these chances with a minimum financial investment of $800,000, which is directed toward development tasks that meet USCIS requirements. One of the vital benefits of purchasing a Regional Center is the lowered requirement for straight task creation; financial investments can qualify based upon indirect tasks produced within the broader economic situation. This adaptability permits investors to take part in tasks that might not have a straight work connection yet contribute positively to the local economy.Moreover, Regional Centers commonly provide considerable assistance, including task administration and reporting, which can simplify the financial investment process for international nationals. The structured nature of these financial investments, incorporated with the capacity for lucrative returns, makes Regional Center Investments an appealing option for worldwide financiers seeking residency in the United States.

Work Development Emphasis

While steering with the EB5 Immigrant Capitalist Program, a primary emphasis continues to be on work creation, which acts as an essential statistics for examining financial investment possibilities. Financiers are needed to create or protect a minimum of ten full-time jobs for U.S. workers, directly connecting their resources financial investment to tangible financial benefits. This demand not just promotes neighborhood employment but likewise promotes local economies.Investment chances under the EB5 Program often align with projects that have a proven track record of task development. Regional facilities, marked by the U.S. Citizenship and Immigration Solutions (USCIS), play a vital duty by merging financial investments into bigger jobs, such as business advancements or framework renovations. These projects are thoroughly made to meet job development thresholds while providing financiers a structured pathway to irreversible residency.Furthermore, concentrating on industries like real estate, hospitality, and renewable resource warranties that investments add to sustainable development. By choosing the best local facility and project, investors can maximize their effect on task development while placing themselves favorably within the united state economic climate (EB5 Minimum Capital Requirement). This twin benefit of economic return and social effect makes the EB5 program an appealing financial investment avenue for worldwide capitalists

Economic Benefits of EB5

Family Members Inclusion in Investments

Family incorporation is an essential function of the EB5 Immigrant Investor Program, enabling investors to prolong advantages to their immediate member of the family. This provision not only enhances the charm of the program but likewise straightens with the values of household unity and shared opportunity. Under the EB5 program, financiers can include their partner and any type of unmarried youngsters under the age of 21 in their application. This means that the whole household can obtain permits, giving them long-term residency in the United States.By including family participants in the investment, the EB5 program acknowledges the significance of family members assistance in the immigrant experience. This addition urges family cohesion, as each member can access the instructional, professional, and cultural possibilities readily available in the U.S. In addition, the capability to move as a family members device can considerably reduce the adjustment and integration procedure, allowing family members to adjust more perfectly to their brand-new environment.The program additionally profits capitalists by boosting the security and protection of their financial investment, as a household that invests together shows a common dedication to developing origins in the U.S. This cumulative technique can lead to an extra satisfying immigration experience, as family members can sustain one another in taking care of the obstacles of moving to a brand-new nation. Overall, the EB5 Immigrant Capitalist Program's emphasis on family members inclusion not just draws in investors however additionally strengthens the program's commitment to fostering family members unity and advertising lasting investment in the U.S. economy.

Risk Mitigation Strategies

Maneuvering the intricacies of the EB5 Immigrant Investor Program calls for a comprehensive understanding of risk reduction techniques to safeguard financial investments and ensure successful outcomes. Similar to any type of financial investment, EB5 individuals encounter various threats, including financial, operational, and governing uncertainties. Efficient danger mitigation is important for protecting capitalist funding and accomplishing the program's desired benefits.One fundamental strategy is carrying out detailed due diligence on the Regional Center and specific jobs in which financiers are thinking about participation. This includes assessing the performance history, credibility, and economic health of the Regional Facility, along with assessing job usefulness and potential for job creation. Financiers should look for openness pertaining to task timelines, financial forecasts, and departure strategies.Diversification is one more crucial strategy. By spreading out financial investments across several tasks or Regional Centers, investors can minimize exposure to any kind of single point of failure. This not just minimizes danger however likewise boosts the potential for returns via varied financial investment channels.Additionally, engaging seasoned lawful and economic advisors can give indispensable understandings right into navigating the intricacies of the EB5 program. Professionals can help in recognizing possible dangers, making sure compliance with regulatory demands, and structuring financial investments effectively.Lastly, financiers must stay educated regarding adjustments in migration plans and economic conditions that might affect the EB5 landscape. Routine tracking of these factors enables prompt changes to financial investment approaches, thereby boosting general security and success in the program. Eventually, a positive and enlightened check here method to take the chance of reduction is extremely important for EB5 financiers looking for to secure their financial future.

Success Stories of Investors

Successful navigating of the EB5 Immigrant Capitalist Program is commonly highlighted through the experiences of financiers who have actually properly handled risks and achieved their goals. One noteworthy success story entails a Chinese business owner who purchased a regional facility focused on renewable energy. By performing extensive due persistance, he not only safeguarded his family's residency in the USA however additionally played a pivotal function in the development of sustainable tasks that amassed area assistance and produced substantial task creation.Another engaging narrative comes from an Indian financier who started a tech start-up in Silicon Valley after effectively getting his EB5 visa. His investment promoted the facility of a firm that ultimately brought in added funding and created over 150 work within three years. This not just permitted him to satisfy the program's requirements yet also enabled him to add to the innovative landscape of the U.S. economy.Moreover, a capitalist from Brazil leveraged the EB5 program to enter the realty market in Florida. By buying a luxury condo project, he not only fulfilled his visa needs yet additionally saw considerable appreciation in residential property value, causing both economic gain and possibilities for his youngsters's education and learning in the U.S.These success stories highlight the capacity of the EB5 program for capitalists seeking to attain immigration objectives while adding to the united state economic climate. By very carefully choosing projects and taking part in positive threat administration, financiers have transformed their desires right into fact, setting a criterion for future participants in the program.

Often Asked Concerns

What Are the Application Handling Times for the EB5 Program?

Application handling times for the EB5 program commonly range from 18 to 24 months. However, these times can differ based upon several variables, including the volume of applications and details regional center participation.

Can I Buy My Own Service Through the EB5 Program?

Yes, you can purchase your own service via the EB-5 program, supplied it meets the needed criteria, including work production requirements and conformity with regulatory requirements set by the USA Citizenship and Immigration Solutions.

Exist Any Type Of Age Constraints for EB5 Capitalists?

There are no details age restrictions for EB-5 investors. Both grownups and minors can participate, supplied they satisfy the financial investment needs. Minors have to have a lawful guardian or representative to handle the investment procedure.

Exactly how Does the EB5 Program Influence My Tax Obligation Commitments?

The EB5 program can influence tax obligations by potentially subjecting financiers to united state taxation on globally income, depending upon residency condition (EB5 Minimum Capital Requirement). It is advisable to consult tax professionals for personalized assistance on ramifications certain to private conditions

What Happens if My EB5 Application Is Denied?

If your EB5 application is rejected, you might shed your investment and might not get a refund. It is vital to comprehend the reasons for denial and discover options for charm or reapplication.